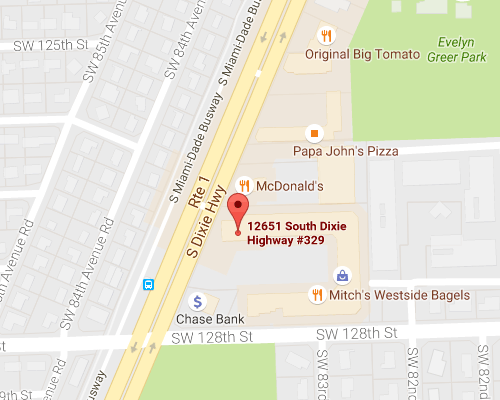

Farm insurance is a complex hybrid type of insurance. Farms are businesses but they are also homes in most cases. All the different parts need to be protected. The insurance that you need to protect your farm should be tailored to your particular needs and having an independent insurance agent that understands the risks farmers face every day is vital. At Hamilton Fox & Company Inc. in Pinecrest, FL, our roots go back 70 years. We believe in exceeding the expectations of our clients and work with them to create a customized insurance solution for their needs.

Home insurance

You have a home on your farm and it needs to be covered the same way that any home is covered. You will have property insurance, content coverage, and liability protection. The property protection covers a detached building like a shed or garage and your lawn and trees, but only plants that are not grown for commercial purposes.

Farm insurance

Farm insurance covers personal property that is directly related to the farming you do. This includes:

Machinery

- Tractors

- Combines

- Hay rakers

- Planters

- Other equipment specific to your farm

If you have a farm truck, it is possible that you will be able to bundle a commercial auto insurance policy into your farm policy,

Livestock

Livestock is covered against basic perils under a standard farm policy. You have the option to add more extensive coverage that covers many more things that could happen to your livestock. Horses require additional coverage from standard farm animals.

Farm Products

Feed, grain and similar products are covered while they are being stored, not in the field.

Farm Liability

Liability is standard on all farm policies and covers the same types of things that commercial liability would cover, including legal fees.

Contact Hamilton Fox & Company Inc. in Pinecrest, FL for help with your farm insurance needs.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions