As a homeowner in the Florida area, you may find yourself pondering on the ideal windows for your home when it is time for replacement. Here are some top types of windows to consider based on safety and pricing.

Double Pane Windows

Double-pane windows are one of the most popular types of windows. These windows offer higher efficiency compared to standard ones that are commonplace in many homes. They provide additional protection against high winds while helping retain more of your home’s heat. Consequently, if your house can maintain its interior temperature, it reduces the workload on your AC unit, resulting in less energy use each month. Ideally, it would be best to consider upgrading all single-pane windows to double-pane windows to make your home more energy-efficient while staying within a reasonable budget.

Triple Pane Windows

Should you have extra funds and are willing to invest more in your home’s windows, you might want to consider the triple-pane windows. They offer even stronger resistance against rain and weather damage, which is quite common in Florida. In particular, if you reside on the coast or have experienced strong wind-related damages to your home, you should opt for the triple pane. Besides offering enhanced security, they provide maximum efficiency in terms of energy use. If your funds allow it, and you crave the best for your home, make sure to opt for the triple-pane windows.

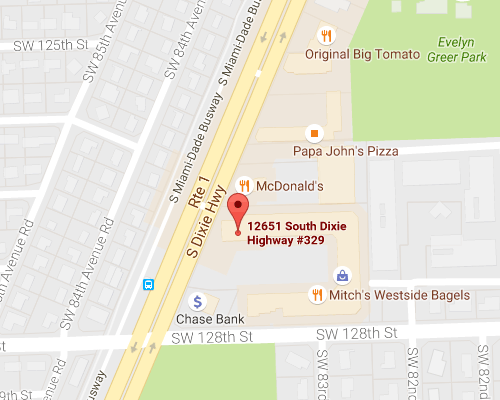

For homeowners around the Pinecrest, FL, area and surrounding communities, it may be high time to consider upgrading your windows. The choice between a double-pane or triple-pane window would depend on your budget and what you deem best for your home. Feel free to contact Hamilton Fox & Company Inc.’s agents today for a personalized home insurance quote.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions