Homeowner’s insurance protects you from several problems that can happen when you least expect them, like fire, wind, and hail damage, or even if your dog bites someone else on or near your property.

But most homeowner’s policies have a deductible, which is the amount you must pay before your insurance will pay anything. Here’s where to set your home insurance deductible and how to get quality home insurance in Pinecrest, FL.

How Much Can You Afford?

The higher your insurance deductible, the lower your monthly premiums will be. The reverse is also true; the lower your insurance deductible, the higher your monthly premiums.

Consider how much you can afford each month to keep your home covered and what kind of cash reserves or other resources you have to pay the deductible in case you need to make a covered claim.

If you can’t afford a $5,000 deductible all at once, you may want to choose a higher monthly cost to get a lower deductible. Otherwise, having insurance is almost moot if you won’t be able to use it when you need it.

What About Disaster Deductibles?

Your standard homeowner’s insurance policy should cover most basic claims, fires, and hurricanes. Other disasters like sinkholes and earthquakes, however, require additional coverage to be purchased. Usually, this has a deductible as well. Flood insurance is a separate policy you should consider getting if you live near water or in a flood-prone area.

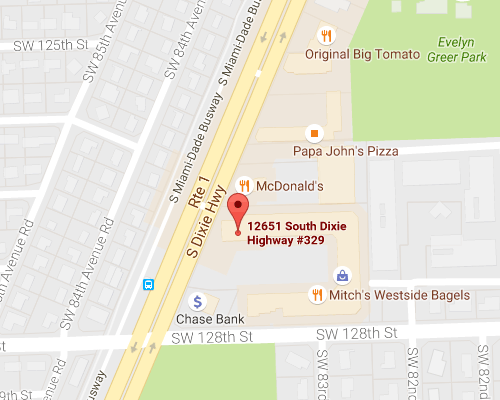

Do you need comprehensive home insurance coverage in Pinecrest, FL? The friendly and experienced agents at Hamilton Fox & Company, Inc. serve your area and are available now to answer your important questions. Call today at (800) 263-1947.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions