Florida is one of America’s states that enjoy warm weather almost the whole year, making it one of the leading boating states in the U.S. While boating is popular in Florida, have you thought about boat insurance?

Although boat insurance is not mandatory, it’s a valuable asset for all boat owners. Boats don’t come cheap. Imagine the cost of replacing your boat in case of an unfortunate occurrence? The truth is boat insurance is as essential as car insurance — it cushions you and your boat when the unthinkable occurs. Hamilton Fox & Company Inc. would like to share why boat insurance matters here in Florida.

Protects you against uninsured and reckless boaters

Since Florida does not require boat insurance, most boaters don’t have this coverage. It means when you get into an accident with an uninsured boater, you could have trouble getting compensation. However, this doesn’t have to be the case when you have invested in uninsured boater coverage.

Protects your asset

Boats are not cheap, and neither are repairs after damage. That said, endeavor to protect your significant investment with boat insurance. Watercraft insurance protects your boat after damage and even when stolen.

Protects your loved ones

Protection against personal injury is an essential component of the boat insurance policy. In the event of an unfortunate incident, you want to be sure you have enough coverage to pay medical expenses for people on board. Boat insurance has that coverage that takes care of such expenses.

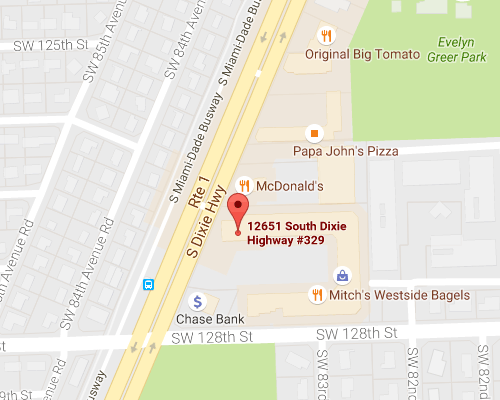

Boat insurance in Pinecrest, FL

There is a lot that can happen on the water. If you can’t be on the road without your car insurance, you shouldn’t ride your boat without insurance. Even for your peace of mind, boat insurance is essential. Ready to purchase your boat insurance in Pinecrest, FL, and its surroundings? Contact us at Hamilton Fox & Company Inc. for an affordable quote.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions