If you’re looking for a worker’s comp insurance policy and have questions call the friendly agents at Hamilton Fox & Company Inc., in Pinecrest, FL.

Worker’s comp insurance is designed to help workers who get injured or become sick because of their job or workplace. The insurance pays for worker’s medical bills and a portion of their lost wages, vocational rehab, in the event of death the funeral and burial costs are also covered. Sometimes workers comp cases end up being settled with a lump sum of money. If it appears or if it does go on for a long time (years) a settlement will be offered by the insurance company who represents and holds the policy for the employer.

Small Business and Workers Comp

If a small business is also an independent business and the only person working at the business is the owner worker’s comp insurance is not needed. If the small business has a co-owner in cases that a policy is needed specifically if one person’s name appears on all the businesses document. If the business has one employee or 300 workers comp is needed.

Large Businesses and Workers Comp

All large businesses that employ at least one person must have worker’s comp insurance. The amount of money an employee must pay for each employee far out weights the amount of money it would cost to pay out of pocket if a worker got injured or sick on or because of the job.

Except in the States of Alabama and Missouri, businesses aren’t required to have workers comp unless they have five employees. Unless it is a construction business then regardless of the number of employees the insurance is necessary.

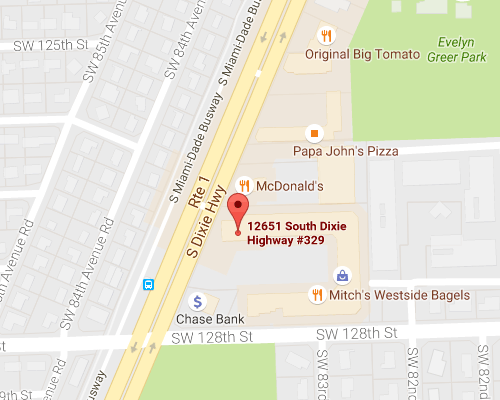

If you need a worker’s comp insurance policy call Hamilton Fox & Company Inc. in Pinecrest, FL call today to set up an appointment.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions