Auto insurance is a contract between you and the insurer, who agrees to pay for certain losses in exchange for your promise to pay premiums. The purpose is to protect other people who might be harmed by your automobile. It also protects you if someone else sues you because of an accident that was your fault.

It also covers the costs of defending you in a lawsuit. When you are involved in an accident and it’s your fault, the other driver can sue you. If they win, the court awards damages to make them "whole" (that is, to put them in as good a financial position as they were before the accident). Your auto insurance policy covers your liability for these damages up to the policy’s limits.

Liability Coverage

When you’re talking about car insurance, liability coverage describes the amount that an insurer will payout in the event of an accident. This coverage is typically divided into two categories: bodily injury and property damage. Bodily injury coverage pays for the medical expenses resulting from an accident, while property damage covers the cost of damage to other people’s property.

Local laws require drivers to carry at least some liability coverage, and the state minimums will usually only be enough to meet this requirement. If you need more protection, it’s usually a smart idea to look for higher limits.

Additional coverage options include:

- Underinsured motorist coverage: This optional policy will help you cover any damages if the other driver’s insurance doesn’t pay up.

- Uninsured motorist coverage: This type of policy can protect you if the accident was caused by a driver who has no insurance.

- Collision coverage: Claims covered under collision insurance are for physical damage to your car caused by an accident.

- Comprehensive coverage: This type of insurance will pay for damages that cannot be attributed to a specific event, like if someone steals your car.

A good auto insurance policy will help cover the costs of getting you back on the road if your car is damaged or stolen. It also offers financial protection in case you’re ever liable for an accident that causes injury to another party.

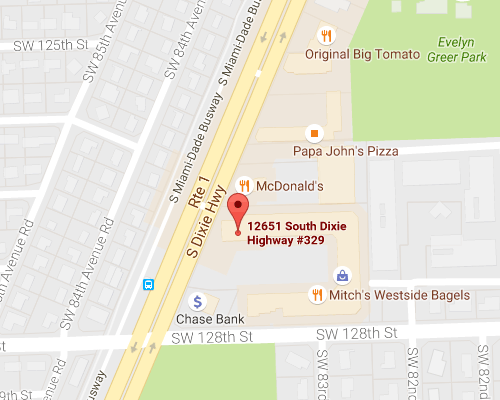

If you are looking for auto insurance in Pinecrest, FL, Hamilton Fox & Company Inc. offers a variety of policies. Contact us today to learn more about them and what auto insurance can do for you.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions