A flood can happen at any time and any place, even if you are not located in a flood zone or an area that is prone to flooding. This is not something that people often think about until it is too late. However, it is essential to know that most home insurance policies do not include flood coverage of any kind. Because of this, many people think they are covered by their home insurance policy when they are not. If the question has come up about whether or not you should purchase flood insurance, here at Hamilton Fox & Company Inc., serving Pinecrest, FL, we believe that it is something everyone should have in Florida.

Why You Need Flood Insurance

- Floods can happen inside your home – You may not think of it, but you can have an internal flood. This can result from a burst pipe or even a sink or bathtub that has started overflowing.

- Hurricanes – Hurricanes happen every year in Florida, and with each one there is a potential for flooding. In fact, a lot of the damage from a hurricane comes from the flooding that results from it. This is something you should prepare for because of your location to the coast.

- External flooding – Even if you are not in a flood zone, you can still have a flood. If your neighbor has an outdoor, above-ground pool and it collapses, you will have a flood on our hands faster than you realize or can react.

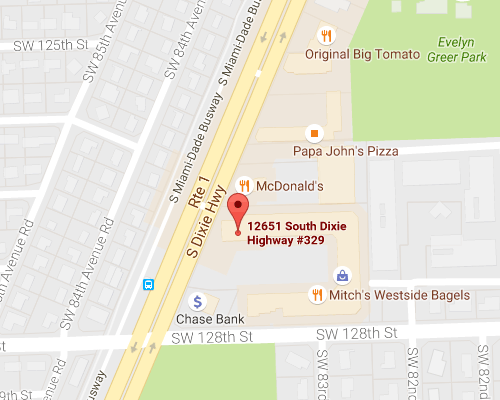

If you are on the fence or simply want to explore your options, be sure to reach out to Hamilton Fox & Company Inc., serving Pinecrest, FL, today. We can help you find the right policy and make sure that it is in your budget.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions