According to Hamilton Fox & Company Inc. in Pinecrest, FL, umbrella insurance gives extra coverage when your policy does not cover a particular situation or when your insurance plan has hit its limit. Imagine how it feels when your insurance provider declines your claim.

Umbrella insurance provides a safety net in such a situation. The question is, what exactly does umbrella insurance cover? Umbrella insurance covers personal liability, lawsuits, damage to property, and injuries to a third party.

Personal liability

The policy covers personal liability for which the existing plan does not cover, especially in a situation where you are not directly at fault. A good example is a situation where your friend knocks down someone in your car. Most auto insurance policies will not cover the damages caused by someone else. Even though you were not the one who drove the vehicle, it is your car. So, you’ll be held liable. Umbrella insurance can be of help here.

Lawsuits

Umbrella insurance does not cover all lawsuits, but it covers the ones for false detention, wrongful imprisonment, wrongful arrest, slander, libel, or malicious prosecution. It means that if someone sues you for any of the crimes listed above and relevant insurance policy cannot cover it, and umbrella insurance will kick in.

Third-party injuries

If you cause someone’s injury, you should foot the hospital bill and also compensate the person. But, what if your current insurance policy cannot handle it? You’ll fall back to your umbrella insurance.

Damage to property

The policy can also help in the situation when you damage other people’s property. A good example is when you mistakenly run your car into a stationary vehicle out of impatience and negligence. Your umbrella policy can help in the situation.

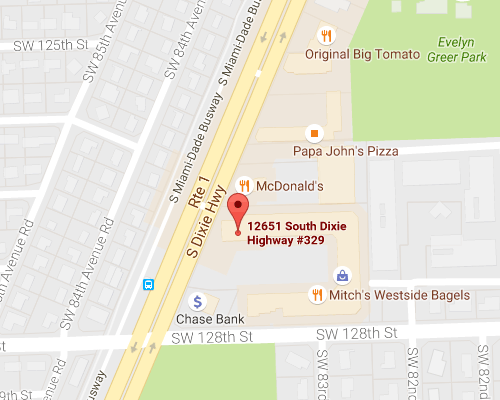

How the insurance works is a little complex, you may need further clarification from your insurance provider. So, if you need further explanation, contact Hamilton Fox & Company Inc.in Pinecrest, FL.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions