There are many people in Miami and Pinecrest, FL who have a misconception about umbrella insurance, thinking that it is meant only for the wealthy. Truth is, umbrella insurance can be advantageous for the average Joe. According to Mitch Freedman, a CPA and finance specialist, "As long as you can earn a livelihood, you should have an umbrella liability policy." Why is this? Well mostly, it is because if you find yourself involved in a lawsuit, you can be liable on a personal level, and not just according to your current assets but also according to your future earnings. Here’s a look at three more reasons you should have umbrella insurance.

Protection In Car Accidents

If you are at-fault for an auto accident and your insurance is exhausted, then you can be held on a personal level to pay for any additional expenses (like medical bills for the other people involved). With an umbrella insurance policy, you can receive additional coverage up to the limits of your policy.

Protection for Personal Accidents On Your Property

Many people find themselves involved in lawsuits due to a person being injured on their personal property. Your homeowner’s insurance will cover up to a certain limit, but you will have to pay out of pocket for any additional expenses that exceed the limit. With umbrella insurance, however, you can receive extra funds to help cover the cost.

Protection Against Slander and Libel

Today’s social media world often finds itself in the midst of lawsuits. A single posting on Facebook can be twisted and used against you, leaving you with an enormous bill for legal fees. With an umbrella policy, you can receive coverage to help cover the expenses incurred.

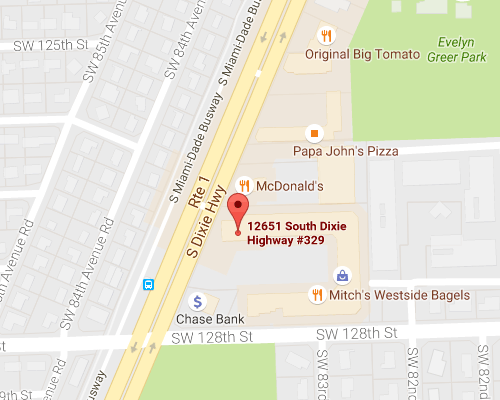

To learn more about umbrella insurance, contact Hamilton Fox & Company Inc. serving the Miami and Pinecrest, FL area. Our agents can help you build a policy off of your current insurance and answer your questions.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions