People who own and drive cars have auto insurance that protects them in case of an accident. People who own houses have homeowner insurance that covers their home, other structures, and personal belongings in the event of a natural disaster or other types of damage or accident. Sometimes these types of insurance are not enough. This is where umbrella insurance comes in.

What is umbrella insurance?

Umbrella insurance is an extra type of liability insurance. Suppose something happens on your property because of your driving or because of your actions, and the costs exceed your base insurance coverage. In that case, umbrella insurance can cover the rest of the expenses.

Umbrella insurance sounds like a wise idea, but it is not suitable for everyone. You might not need umbrella insurance if your base auto or home insurance is enough coverage for your liability risks. If you have a high net worth and things that will put you at a higher risk of a lawsuit, you might want to consider getting umbrella insurance.

Why is umbrella insurance important?

Umbrella insurance is needed because if something happens and the liability costs exceed your base coverage, you could lose a lot financially. If you have umbrella insurance, the costs would then be covered by umbrella insurance instead of being paid out of your pocket.

If you have any of the following things that put you at a higher risk of liability, you might want to consider umbrella insurance.

-

Swimming pool

-

Dogs

-

Boat

-

Trampoline

-

Anything that puts you at a higher risk of a lawsuit

Contact Us

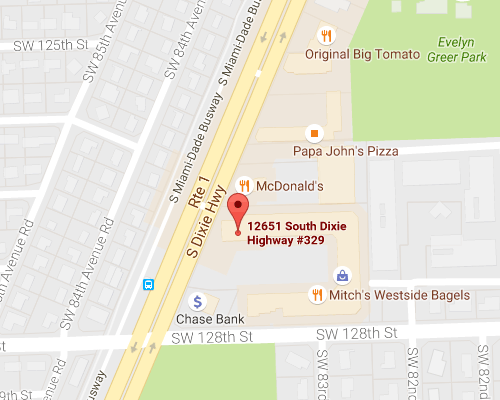

If you are considering whether an umbrella insurance policy is right for you in Pinecrest, FL, stop in or contact us at Hamilton Fox & Company Inc for more information.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions