Hamilton Fox & Company Inc. is here to meet the insurance needs of the residents in Pinecrest, FL, and the surrounding areas. If you have questions about flood insurance, we are here to help. There are many reasons why someone may want flood insurance, even if they don’t live in a flood zone. Give us a call today to discuss this topic!

Obtaining flood insurance in non-flood plane locations

When you live in a flood zone, it will be very apparent that you need flood insurance. Your mortgage provider will likely require that you have such a policy as a condition to close on your house.

But what happens if you live outside of a flood plane? Several benefits come with having a flood insurance policy in place, no matter where you live.

Most homeowners’ policies don’t provide coverage for damage caused by flood waters. This can mean that if a flood damages your house, you will have to come out of pocket to pay for the repairs. No one wants this to happen, which is why many people outside of a flood zone have a supplemental flood insurance policy.

This extra insurance can make a massive difference if your home is damaged because of a flood. Want to find out more? Give us a call today.

Call us today with your flood insurance questions!

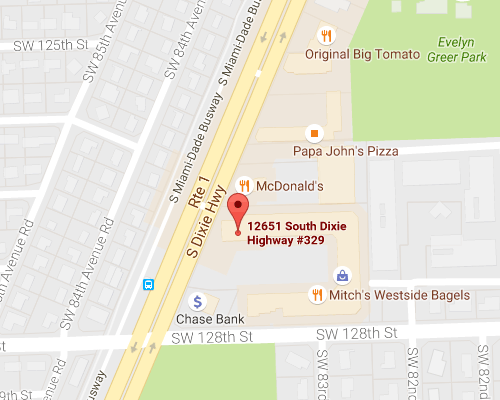

Many residents in the Pinecrest, FL area can benefit from having a flood insurance policy in place. The Hamilton Fox & Company Inc. team can answer any of your flood insurance questions. Contact our office or stop by today to find out more.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions