Did you know that your home insurance doesn’t cover your Pinecrest, FL home against flood damage? For this reason, you need flood insurance from Hamilton Fox & Company Inc. for optimal protection. But what is flood insurance? What does it cover? If you need answers to these questions, read through our FAQs section below.

What does flood insurance cover?

When you buy flood insurance Hamilton Fox & Company Inc. covers the below:

Structure of your home: Did you know that a one-inch rise in water level can cause damage to up to $25,000? Floods can cause unspeakable damage to your structure. As such, you need flood insurance to cover your structure’s walls, floor, roof, and other fixed appliances.

Contents: Flood insurance covers not only the physical structure of your property but also its contents. Assets such as the following are protected:

- Cabinets

- Applies

- Carpet and flooring

- Heating and air conditioning unit

- Electrical and plumbing system

Is flood insurance mandatory?

No law in Florida requires flood insurance. However, private and government-backed mortgage lenders will deny you a mortgage when you fail to obtain flood insurance if you live in high-risk flood areas.

What are flood insurance exclusions?

Your flood insurance coverage will not cover the following:

- Additional living expenses that you may incur as your home is undergoing repairs. These are covered under home insurance.

- Damage caused by earth movement, even where floods are the cause.

- Moisture, mold, or mildew damages that the homeowner could have prevented.

- Loss of income in case of a business.

Since floods can strike anywhere, whether you live in low-risk or high-risk flood areas, you need flood insurance for protection and peace of mind. Please don’t wait to face the consequences when it’s too late. Instead, connect with Hamilton Fox & Company Inc. in Pinecrest, FL for an affordable flood insurance quote.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

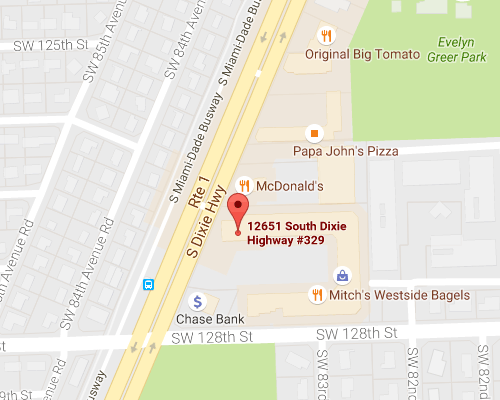

Get Directions