Flood insurance is the type of coverage, the purpose of which is to protect your home, your personal belongings, and financial wellbeing in case if your house is damaged by water. Flooding remains one of the most common natural disasters in the United States, which makes flood insurance so important to have. On average, a flood can cause up to $25,000 worth of damage.

The way flood insurance works is similar to your auto or home insurance. If the flood occurred and caused the damage, you need to document everything, file a flood insurance claim, and let a licensed adjuster have a look at the damage in order to process the claim you filed. Once everything is done, your insurance company will give you a check for the damages and you will be able to use it to repair the house and restore whatever was damaged or destroyed.

It is also important to know that standard home insurance does not cover flood damages. Therefore, even if you have your homeowners’ insurance already, you still need to purchase flood insurance separately to protect your home from a flood.

There are two ways to purchase food insurance – either through The National Flood Insurance Program (NFIP) or through one of the private insurance companies of your choice. Even though it is not required to have flood insurance in Florida, it is still highly recommended to get one because the entire state of Florida is in a flood zone.

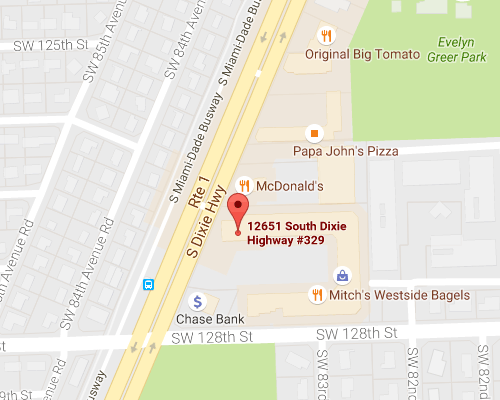

If you are a resident of the Sunshine State and you are looking for a reliable insurance agency to purchase flood insurance, Hamilton Fox & Company Inc. serving Pinecrest, FL is ready to assist you. Whether you live in Pinecrest, FL or any other surrounding town, give Hamilton Fox & Company Inc a call today to discuss how you can protect your home and belongings from unpredictable flood events.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions