Being a business owner in the Pinecrest, FL area can be a great way to earn a living. When you start a business, you will want to know that you have appropriate insurance at all times. When looking for insurance here, worker’s comp insurance is one type of coverage. This type of coverage will provide excellent support, which should be considered a necessity for various reasons.

Provide Protection to Employees

One of the reasons you should get a worker’s comp plan for your business is to provide protection for your employees. The primary purpose of this type of coverage is to ensure your employees have the care and support they need if they are injured while working. This can include covering medical bills, lost wages, and other costs.

Comply with Law

It is also a good idea to have a worker’s comp plan so you can comply with the law. In Florida, all businesses of a specific size are required to get this insurance if they have employees. If this insurance does not cover you, you will violate the law and can face various penalties, which could impact your business reputation.

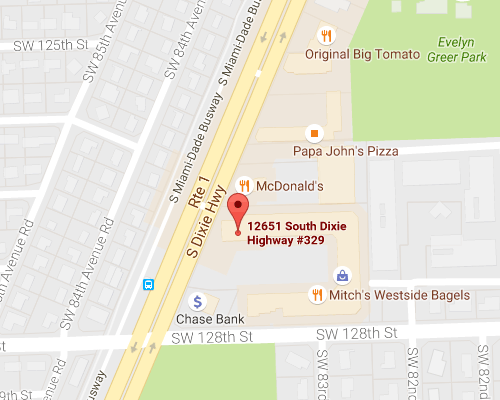

As you are looking to build a business in the Pinecrest, FL area, there are many forms of insurance that you will want to get, and talking with our team at Hamilton Fox & Company Inc. can be a great way to start the process of obtaining a new policy. When you speak with our team at Hamilton Fox & Company Inc., you will receive ideal guidance and support to help you build your next policy.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions