Business owners know that purchasing the right commercial insurance is essential for protecting your company and ensuring its ongoing success. However, many businesses make one or more common mistakes when shopping for this essential coverage, often resulting in costly and unnecessary issues down the road. If you want to avoid these common pitfalls, it’s crucial to be aware of the most common ones.

1. Failing to Consider the Full Scope of Coverage

One of the biggest mistakes businesses make when buying commercial insurance is failing to look at coverage comprehensively. A common situation involves buying general liability insurance but not considering property damage or professional liability. You may be leaving your business open to unnecessary risk and out-of-pocket expenses later on.

2. Not Updating Coverage Regularly

Another common mistake is not updating your coverage regularly. As your business grows and changes, so too should your insurance coverage. Failing to do so can result in gaps in protection that could leave you vulnerable to loss in an accident or other unforeseen circumstances.

3. Buying Too Much or Too Little Insurance

Another common mistake is buying either too much or too little insurance. While you don’t want to be underinsured, it’s also vital to avoid over-insuring your business. This can result in wasted money that could be better used elsewhere.

4. Failing to Shop Around

Many businesses make the mistake of failing to shop around when it comes to commercial insurance. This is often due to the mistaken belief that all insurers are the same. However, this isn’t the case. There can be significant differences in terms of coverage and cost from one insurer to another. As such, it’s essential to take the time to compare rates and coverage before making a final decision.

5. Not Knowing What to Look for in a Policy

Another common mistake is failing to know what to look for in a policy. Many business owners accept whatever policy their agent recommends without fully understanding its terms and coverage. This can lead to surprises later on, such as the lack of coverage you need when you think your business is adequately covered.

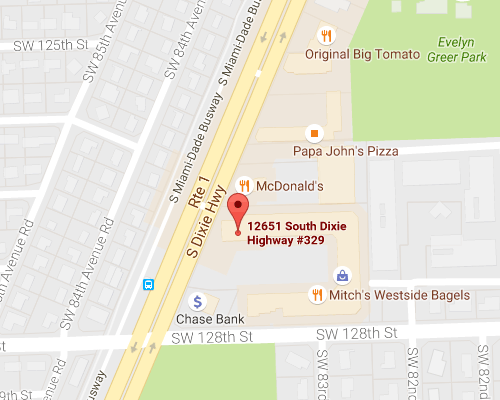

Get Commercial Insurance in Pinecrest, FL

Business owners can avoid these common mistakes and ensure they’re getting the right coverage for their needs by working with an experienced insurance agent. At Hamilton Fox & Company Inc., we can help you find the right commercial insurance policy for your business. Contact us today to learn more.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions