Many people already have protection through car insurance, homeowner’s insurance, and other insurance policies. Still, in some cases, those policies may not cover enough when you are liable for an accident. The good news is that at Hamilton Fox & Company, we are happy to offer people in Pinecrest, FL, umbrella insurance, which can cover liability costs that other insurance policies don’t cover.

What’s the Point of Umbrella Insurance?

Serious accidents can lead to significant expenses. For example, if someone trips and falls at your house, they may sue you for the damages they have experienced due to that fall. These types of incidents can lead to huge expenses, and if your existing insurance policies only cover a portion of those expenses, you can be left with payment due that you can’t afford to pay.

Umbrella insurance policies basically hang over your other policies, such as home or car insurance. When you reach limits on those policies, your umbrella insurance can protect you by covering otherwise uncovered costs.

What Does Umbrella Insurance Cover?

Umbrella insurance can cover a range of costs that other policies may limit. Some lawsuits, property damage, injuries, personal liability, and other liability situations that are not covered by other policies can be covered by umbrella policies. The exact specifications of what the policy will cover will vary from policy to policy, so you always want to look at the types of liabilities a policy covers.

Who Should Get Umbrella Insurance?

Many people may think they are well covered by existing policies, but there may be huge limits in those policies that could cause much lasting damage without additional coverage. Many people can benefit from an umbrella insurance policy, but people with higher potential liability will especially want to consider this policy. For example, people with dogs, property hazards, trampolines, or swimming pools may have higher risks that could benefit from umbrella coverage.

Cover Yourself for Unexpected Storms

When you have an umbrella ready, unexpected storms are a lot easier to manage. If you’re prepared to get an umbrella policy, Hamilton Fox & Company Inc. will be happy to help you in any way we can. We offer Pinecrest, FL, residents clear, concise information so they can make the best policy decisions for themselves and their families. Contact us to learn more about umbrella insurance and available policies.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

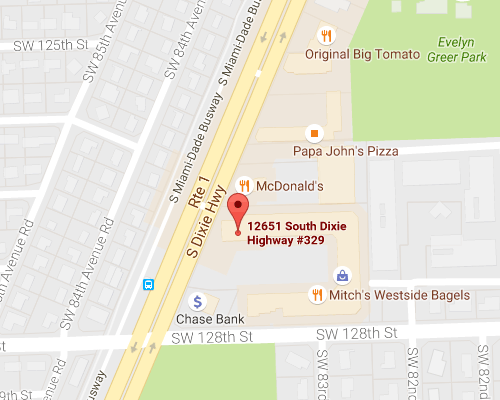

Get Directions