A lot can happen to your home from year to year in Pinecrest, FL. It’s critical that you keep your home insurance policy up to date. Otherwise, you run the risk of not having the coverage that you think you do. At Hamilton Fox & Company Inc., we recommend reviewing your policy every single year.

There are quite a few things to look at when you review your home insurance policy. This includes the cost as well as the coverage. The cost may vary from year to year, which is also why you should get quotes from multiple insurance companies on an annual basis. As for the coverage, if you have added various components to your homes, such as a pool or a free-standing garage, these need to be added to your policy.

You may qualify for new discounts, too. If you fenced in your yard or added a security system, you have made your home safer. It’s worth mentioning to the insurance company as they may supply you with a discount.

Since so much can happen in a year, you might not think to add them as they occur. By taking the time to review the details of your policy, you can make sure that everything you own is covered. If you have made a number of major purchases, you may even want to add a high-value rider so that you are protected if your personal belongings are damaged or stolen.

You will want to protect your home in Pinecrest, FL however you can. While it’s easy to think that your home insurance policy is enough, you have to keep it updated. Contact us at Hamilton Fox & Company Inc. today so that one of our independent insurance agents can help you with any updates that need to be made to your policy.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

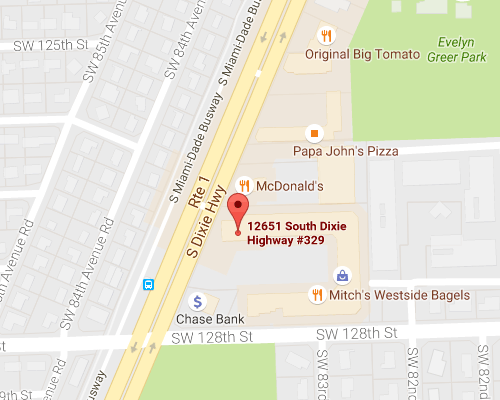

Click to Call Get Directions

Get Directions